Plastics insurance

Expert underwriters you can rely on

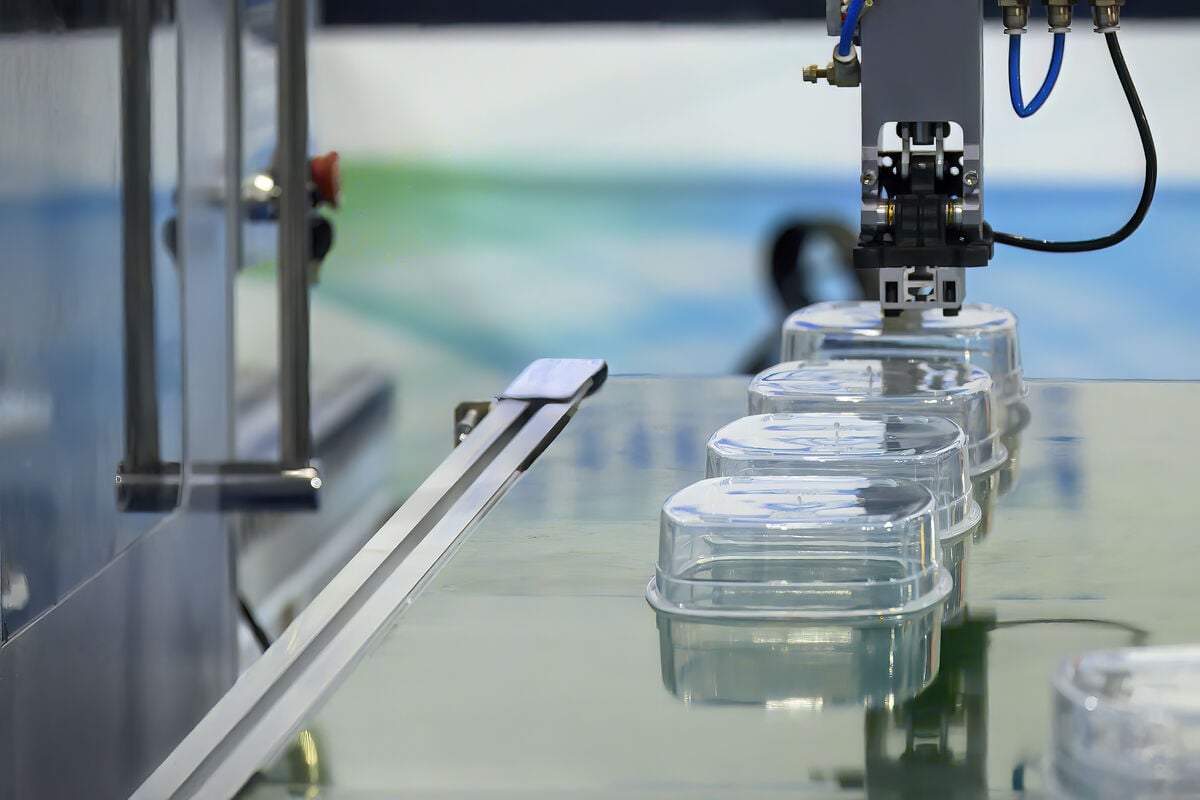

With experienced underwriters who understand the diverse nature of the trade, a flexible approach to underwriting is essential without compromising on the level of cover. Our specialist plastics policy has been developed with the industry in mind to offer a wide breadth of cover to help ensure your client’s business has the right insurance in place to protect their premises, equipment and employees and customers.

Key features

- Direct claims reporting with our capacity providers

- Specialist knowledge of the industry

- Ability to write in conjunction with our separate aviation products liability offering

- Property section including full theft cover, stock at subcontractors, exhibition cover, automatic cover for moulds, dies and tools a swell as nonmanufacturing machinery breakdown cover

- A wide selection of BI extensions including AICOW, book debts, customer and supplier extensions, essential employee cover and loss of attraction

- Occupational accident and computer breakdown

- Legal expenses including contract disputes and a 24-hour advice line

- Optional extensions including directors & officers, engineering inspection, financial loss, full fidelity/theft by employee, 24-hour personal accident and terrorism.

Our risk appetite

Premises-based risks with work away up to 50% of the manual wage roll. Our target trades include although are not limited to:

Light precision processes

Injection moulding

3D printing

Thermoforming

Laminating

Rotational moulding

Plastic extrusion

Vacuum casting

UPVC double glazing

Resources

Our team are here to help

Linda Bichener

Linda Bichener

Underwriting Manager

Linda is the Underwriting Manager for the DUAL Commercial team, joining in 2000 and has been instrumental in the growth of the company. She provides a wealth of experience gained from 23 years in Property and Casualty underwriting, focusing on management in specialising schemes.

Outside work, Linda enjoys cooking, reading, reality television and travel.

Leah Miller

Leah Miller

Senior Underwriter

Leah is a Senior Underwriter in the DUAL Commercial team, joining in 2022 and has over 18 years’ experience in the industry. She began her career in a leading broking firm and moved to underwriting in 2012, specialising in commercial and unoccupied insurance.

In her spare time, Leah takes long walks with her Springer Spaniel dog, loves trips to the theatre and enjoys shopping for vintage clothing.